U.S. President Joe Biden signed the $1.9-trillion American Rescue Plan (ARP) Act into law on March 11, delivering on one of his key campaign promises. After the signing, Biden called the bill a historic legislation with overwhelming support from Americans, saying it will help rebuild the COVID-19-ravaged U.S. economy.

Though a survey released by the Pew Research Center showed that 70 percent of Americans said they favor the legislation, Republicans in the Congress strongly opposed it. They argued that some provisions are unrelated to the epidemic and it could produce unsustainable debt for future generations. In both the Senate and the House of Representatives, the bill failed to secure even a single Republican vote.

Some economists have also warned that the massive relief package could result in multiple risks including rising inflation pressure and global financial instability.

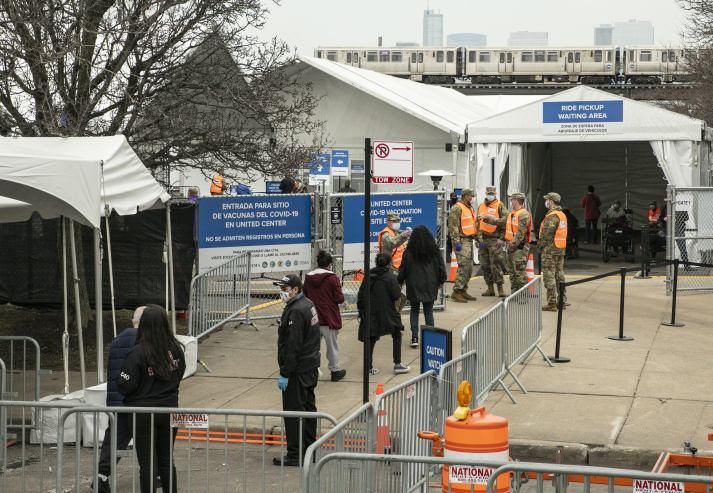

People line up to receive COVID-19 vaccine dose at an inoculation site in Chicago, the U.S., on March 10 (XINHUA)

Relief needed

Following the outbreak of COVID-19, the U.S. economy has sharply contracted, leading to soaring unemployment and declining incomes. In middle-February, the total number of people claiming benefits in all programs—state and federal combined—rose by 2 million to 20.1 million, indicating continued disruption to the labor market by the pandemic. As many Americans do not have any savings, they often have to rely on federal aid payouts to make ends meet.

Undoubtedly, the two rounds of COVID-19 relief packages during former President Donald Trump's administration did play an extremely important role in supporting the residential income. Nevertheless, on March 14, the two rounds of COVID-19 rescue support under Trump expired, and the passage of the ARP became a lifeline to prevent many residents from falling off the "financial cliff."

Compared to Trump's relief packages, the ARP gives more attention to local and minority communities. It includes funding for COVID-19 vaccination and testing, as well as support for small businesses, state and local governments, along with schools.

Furthermore, the ARP features the expansion of unemployment benefits and relevant services, and waives federal tax on up to $10,200 of unemployment benefits for single adults who earned less than $150,000 in 2020. Additionally, it provides that, through 2025, any student loan that is forgiven by the lender will not carry an income tax liability. The act also grants a direct payment of $1,400 for individuals earning less than $75,000.

A staff member of Planet Fitness prepares for reopening to the public in Los Angeles County, California, the U.S., on March 15, as the county loosened restrictions for COVID-19 (XINHUA)

Long-term impact

While the relief package might prove a solution for the problems at hand, various concerns regarding its limited effects persist.

First, the number of recipients covered by the ARP has greatly expanded, resulting in the reduced effectiveness of financial support.

The ARP establishes a state and local recovery fund, with local governments able to apply for public health emergency expenditures related to COVID-19 from a total funding of $219.8 billion before

December 31, 2024. That said, on average, the funds available to each state will amount to some $4 billion, equivalent to only $1 billion per year.

Moreover, these funds can only be used to cover those costs responding to the COVID-19 measures and are not allowed to supplement pensions and other issues related to a lack of capital.

Second, the additional cost to ensure the compliant use of funds is on the rise. The COVID-19 relief plan for small businesses during Trump's administration raised many questions, with rumors of faulty data collection casting doubt on the real economic impact of the program.

Therefore, the ARP comes with far more stringent restrictions such as a shortened period of financial support, and a reduced quota of new applicants.

All combined, these factors have increased the cost of administrative management, and would possibly diminish eligible firms' willingness to apply for financial support.

Third, the $1,400 direct payment to many Americans might be a highlight of the ARP, but the recipients may not feel so upbeat about it. Although the U.S. consumer price index (CPI) rose to 1.676 percent in February, lower than the Federal Reserve's target of 2 percent, the inflation pressure is going up. The overall rise in prices thereby lessens consumer perception of actual financial support.

The impact of the expansionary fiscal policy cannot be understated. The GDP of the U.S. in 2020 was about $21 trillion. The fiscal year 2020 witnessed the federal government's expenditure increase 47.3 percent year on year, and its fiscal deficit triple to over $3.1 trillion, signifying a fifth consecutive year of increase.

Based on calculations, the ARP will increase the U.S. budget deficit by $1.16 trillion in 2021. The negative impact will gradually decrease, and the budget deficit will begin to decline in 2026. The fiscal revenue is expected to recover to growth in 2023, after an initial decrease by $75.42 billion and $52.44 billion in 2021 and 2022, respectively.

Nevertheless, from 2021 to 2030, the U.S. Congressional Budget Office predicts that the ARP will boost growth at a cost of a higher fiscal deficit, totaling $1.86 trillion. Considering Biden's upcoming $3-trillion tax and infrastructure package, the pressure on the U.S. fiscal deficit will continue to intensify significantly.

(Print Edition Title: Temporary Relief)

The author is a senior researcher with the Chinese Academy of International Trade and Economic Cooperation

Copyedited by Elsbeth van Paridon

Comments to yanwei@bjreview.com