|

No Impact on the Surplus

|

|

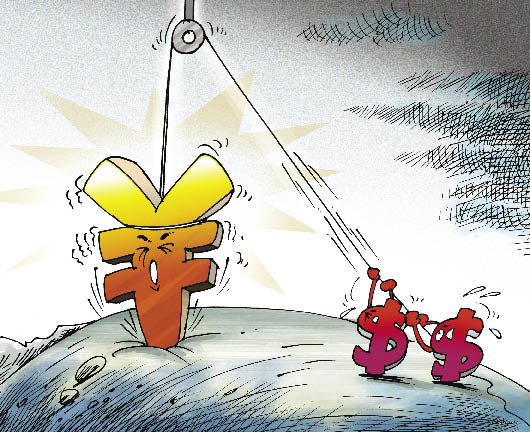

The U.S. persists in urging China to allow the yuan to rise against the U.S. dollar. China Foto Press |

CT: Is there an inherent correlation between the RMB exchange rate and China-U.S. trade?

Zhao Zhongxiu: Since the first China-U.S. Strategic Economic Dialogue in 2005, the RMB exchange rate has always been a hot topic.

After the RMB exchange rate mechanism reform kicked off in July 2005, the yuan has risen in value against the U.S. dollar by 21 percent. Even during the global economic downturn from July 2008 to February 2009, the yuan remained stable and the real effective rise was 14.5 percent.

According to the Ministry of Commerce, 16 out of 37 countries that exported to China in 2009 reported increase in export volume. Despite the fact that the overall export volume of European Union members decreased by 20.3 percent, the part to China was down by just 1.53 percent. Among them, German exports to China reached €76 billion in 2009 – the highest in history. Similarly, U.S. overall export volume shrank by 17 percent, whereas the volume of exports to China declined by only 0.22 percent. Undoubtedly, China has become the main export market for neighbors such as Japan and South Korea and a significant buyer of European and American goods.

These hard facts show there is no inherent correlation between the RMB exchange rate and the imbalance of China-U.S. trade. The experiences of Japan and Germany prove that currency appreciation does not necessarily reduce trade surplus. Exchange rate movement is determined by a nation’s overall economic situation and all factors of its foreign trade.

CT: In that case, why is the United States pressing China to revalue its currency?

Zhao Zhongxiu: One important reason is that a stronger yuan will raise the cost of Chinese export goods on the global market, thereby weakening their competitiveness. Meanwhile, it might stimulate China to buy more from other countries, including the U.S.

Not a Cure

CT: How does the trade deficit impact employment in the United States?

Zhao Zhongxiu: Foreign trade deficit has been a long-standing problem for the U.S. In 2008, the deficit was US $700 billion. It fell somewhat in 2009, as overall foreign trade shrank amid the financial crisis. As of January 2010, the U.S. trade deficit stood at US $43.3 billion, including US $18.2 billion with China, US $4.6 billion with Mexico, US $3.9 billion with Canada, US $3.3 billion with Japan and US $2.8 billion with the E.U.

That the U.S. has a trade deficit with many nations is attributable to its production structure. A major consumer nation, the U.S. is reliant upon imports for many consumer goods, having transferred much of its manufacturing to overseas factories. Today, the U.S. is a user, but not a producer, of many kinds of home appliances. Seen in this light, the U.S. trade deficit with a number of countries is rooted in its industrial and consumption structures.

Regarding unemployment in the U.S., the issue is hinged on the nation’s economic structure. The service industry (e.g. finance) has been exceptionally vigorous, but when it tumbles the laid-off employees may face long-term unemployment (the U.S. government classifies as long-term unemployed anyone without work for over 26 weeks), for domestic manufacturing has limited capacity to absorb them. For those pruned from the manufacturing sector it remains an open question whether all are ready to take on service jobs, which are lower-paid.

Owing to the financial crisis, the U.S. unemployment rate climbed from 5.8 percent in July 2008 to 10.1 percent in October 2009. It slid to 9.7 percent in January this year, but remained way above the natural level of 5 percent.

The U.S. Department of Labor reported that jobs in service industry decreased by 147,000 in September 2009, by 64,000 in construction industry, by 53,000 in government departments, and by 51,000 in manufacturing industry. We can see that the greatest reduction was in service industry, a field in which the U.S. has a surplus with China. Therefore, lessening the U.S. trade deficit in goods with China would have little direct impact on employment in the U.S.

CT: Would yuan appreciation solve the U.S. trade deficit and unemployment problems?

Zhao Zhongxiu: The relationship between currency appreciation and the balance of trade is a rather weak one. The history of U.S. trade with Japan, Sweden and Germany illustrates that the exchange rate is not the basic determinant of the balance of trade. The U.S. didn’t see a reverse of its high deficit in trade with Japan after the Japanese yen was forced to revalue in 1985.

As a matter of fact, no economic entity in the world is capable of precisely estimating the so-called equilibrium exchange rate. The balance of trade results mainly from the trade structure and the composition of industry. Besides, it is influenced by the macro economy, by productivity, and by the price of factors of production too. Therefore, it is extremely inadvisable to maneuver a country’s trade balance by means of exchange rates. Even more to the point, it will have little effect. |