Greater Use of RMB in Global Payments Imminent

The Chinese government has also introduced measures to facilitate RMB settlement. September 2010 saw the promulgation of Measures for the Administration of Renminbi Settlement for Cross-border Trade, and Rules for the Implementation of the Measures. China has relaxed its control over foreign exchange over the past years, making RMB settlement easier. In May 2013, the PBC released rules governing a pilot program for domestic securities by RMB-qualified foreign institutional investors (RQFII), which promotes the establishment of more RQFIIs. In July 2013, the PBC adopted simplified measures for cross-border RMB business and amended the relevant rules. In December that year, the Ministry of Commerce announced the Notice on Relevant Issues of China Foreign Direct Investment outward, and the State Administration of Foreign Exchange issued the Adjustments of the Management of RMB-Foreign Exchange Derivatives Business, simplifying procedures for foreign-exchange swap transactions. In April 2014, the State Administration of Foreign Exchange issued the Notice about Several Issues Concerning Collective Operation of Foreign-exchange Capital of Multinational Corporations (for Trial Implementation), which allows multinational businesses to freely transfer money between domestic and overseas bank accounts within stipulated sums.

The above measures have substantially boosted RMB use in international trade and investment. The volume of RMB settlement for cross-border trade reached RMB 2.08 trillion in 2011, marking a 3.1-fold growth over the previous year. The figure continued to rise in 2012, to RMB 2.94 trillion, gaining 41 percent year-on-year, and then RMB 4.63 trillion in 2013, up 57 percent. In the first quarter of 2014 the volume of cross-border RMB settlement hit RMB 1.65 trillion, surging 65 percent year-on-year.

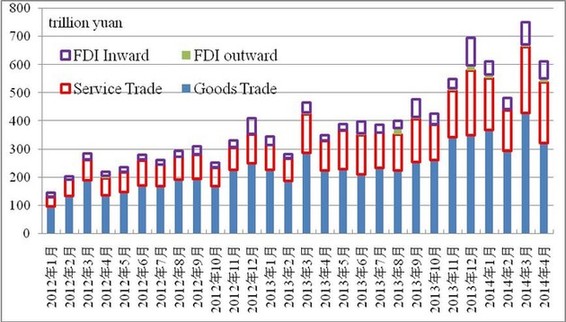

As can be seen in Table 2, during the period from January 2012 to April 2014, the volume of RMB settlement for cross-border trade climbed from RMB 128.4 billion to RMB 536.6 billion, and that for foreign direct investment (FDI) multiplied from RMB 15.2 billion to RMB 75.9 billion. Breaking it down, the volume of RMB settlement for cross-border commodity trade soared – from RMB 95.1 billion to RMB 321.2 billion over the period; while that for service trade and other items under the current account swelled – from RMB 33.3 billion to RMB 215.4 billion; that for outward FDI – from RMB 1.7 billion to RMB 15.6 billion; and that for inward FDI – from RMB 13.5 billion to RMB 60.3 billion.

|

|

|

Table 2: Share of RMB Settlement in Cross-border Trade and Investment |

Paths to RMB Becoming More Accepted

Despite all the advances made over recent years, Renminbi usage in global payment remains at a low level when compared with the U.S. dollar, euro, British pound, Japanese yen, Australian dollar, and Canadian dollar. A SWIFT report of April 2014 shows that these currencies’ international shares are, respectively, 40.19 percent, 31.78 percent, 9.24 percent, 2.49 percent, 1.84 percent, and 1.83 percent. Thus the RMB has a lot of catch-up to do.

But China’s currency is destined to be increasingly used globally, as the country’s economic, trade and investment strength continues to grow. At present, the international status of the RMB is incommensurate with the status of the Chinese economy. With a share of 13 percent, China topped the world’s commodity trade last year. But the use of RMB in transaction settlement remains low, at 6.6 percent, 8.4 percent and 11.7 percent, in 2011, 2012 and 2013, respectively. Even at the highest record, of 11.7 percent, half of the settlements were not RMB-denominated.