By LI GANG

THE Chinese economy has grown rapidly in the three or more decades since the reform and opening-up policy came into effect, achieving an average GDP of more than 10 percent per year. This success is owed mainly to export and investments. The old economic growth model suited the country’s former conditions of inadequate supply and cheap labor. It indeed played an important role in boosting economic growth by establishing and upgrading the industrial system and improving people’s livelihood. Its drawbacks due to immoderate reliance on exports and investment, however, have gradually become apparent amid changed social and economic conditions. Excessively high levels of investment have resulted in serious overcapacity in some industries, as well as low productive efficiency and economic imbalances. Large scale investment is also the culprit of a steady climb in the government debt-to-GDP ratio. Moreover, a growth model that overly depends on exports renders the Chinese economy vulnerable to the vagaries of the global economy. Since November 2012, when the new generation of China’s leaders took office, China has formulated new blueprints for its economic development which have thrown into sharp relief the road map of economic growth transformation.

Li Gang, PhD in economics, is a research fellow at the Institute of European Studies in Chinese Academy of Social Sciences. From 2010 to 2011, he did research on EU regional policy at the Department of Public Administration at Erasums University Rotterdam. His study fields include global economic governance, social housing policy in European countries and the U.K. economy.

The Third Plenary Session of the 18th Central Committee of the Communist Party of China (CPC), held on November 12, 2013, adopted the “Decision of the Central Committee of the CPC on Some Major Issues Concerning Comprehensively Deepening the Reform.” The document covers the economic, political, social, cultural, and ecological spheres, including reforms in 60 sub-fields, so marking a watershed in China’s economic transformation. The Outline of the 13th Five-Year Plan on National Economic and Social Development from 2016 to 2020, approved by the National People’s Congress last March, sets the target whereby China will shift in the coming five years from an industry- and investment-led economy to one that is driven by service, innovation, and consumption.

Consumption will be the fundamental driver of this new growth model. Its key points include perfecting the social security system and establishing a social safety net, which will increase citizens’ disposable incomes and liberate their purchasing power, thus promoting consumption. Meanwhile moves are afoot to promote marketization of China’s financial market and to eliminate financial constraints, so providing a benign financing environment. The resultant surge in consumption will create rational investment growth that promotes economic growth and employment.

From a long-term point of view, the transformation of China’s economic growth model is conducive both to China’s sustained and healthy economic development and global economic growth. In other words, China’s sustained and stable economic growth, upgraded consumption structure, optimized industrial structure, and new-type urbanization progress will bring benefits to the country and also new opportunities for the economic development of other countries.

China’s Contribution to Global Economic Growth

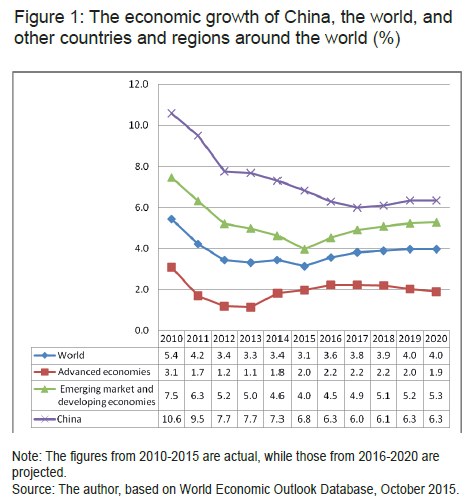

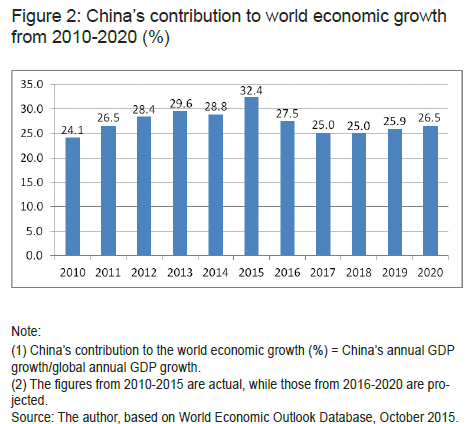

China’s economy is currently operating under the “new normal,” whereby it grows at a medium-to-high pace. But it is still a major engine of the world economy, the country’s economic growth rate exceeding by far the global average. China’s economy grew 7.7 percent in 2012 – the first time since 2000 it had dropped to below 8 percent, and slowed to 6.9 percent in 2015. Although in the midst of a slowdown, China’s economy is still operating within a reasonable range, and has attainable annual growth targets. On a global scale, the economies of China and of the world have slowed down, but China’s economic growth still outstrips that of developed economies, the world, and emerging economies. (See Figure 1) It is notable that despite this slow-down the country’s share in the global economy climbs year-on-year. IMF forecasts imply that by 2020 China’s share in global GDP will expand from the current 17 percent to almost 20 percent. China still plays a vital role in the global economy, therefore, as it remains a major driving force of global economic growth. Published IMF data show that China contributed 32.4 percent to world economic growth in 2015, and estimate that it will contribute an annual average of more than 25 percent to global economic growth in the period from 2016 to 2020. (See Figure 2)

Upgraded Consumption Structure Boosts Global Exports

As China’s economic growth model transforms, further rein will be given to Chinese residents’ consumption demands, and its expanded imports will boost the exports and economic development of other countries. From a historical perspective, China’s consumption has undergone a shrinking trend over the long term, the country’s consumption having fallen from about 51 percent of GDP in 1985 to 38 percent in 2005. Major reasons include distorted labor force costs, an unsound social security system, and a high rate of marginal propensity to save (MPS). However, the establishment of a demand-driven economic growth model will reverse this trend. Transformation of the economic growth pattern from investment- to consumption-driven entails increasing residents’ disposable income, so stimulating consumption spending. Such measures as increasing salaries, perfecting the social security system, supporting the development of small-and medium-sized enterprises, and encouraging entrepreneurship will help to increase the disposable incomes and promote expansion and growth of China’s middle class. More than 75 percent of China’s urban consumers will earn RMB 60,000 to RMB 229,000 (US $9,000 to US $34,000) a year by 2022, according to research by McKinsey & Company. By then the middle-class population will hit 630 million, and become a main consumption force of middle-to-top grade consumer goods, modern services, and intellectual products. It is estimated that by 2020, consumption will account for 45 percent of China’s GDP. Chinese consumers will display a growing demand for imported high quality or high-tech products and service products, in terms of finance, healthcare and education. This will provide great opportunities for exporters of such goods and services in other countries. The IMF forecasts that imports of China’s goods and services will grow an average 3.9 percent every year from 2016 to 2020.

Optimized Industrial Structure Brings Opportunities and Dynamism to Developed Economies

Under the new economic development model, China will expand the proportion of high-end manufacturing, strategic emerging industries, and modern services in the general industrial structure. After years of development, China has benefited from enhanced advantages in mid-end manufacturing, such as telecommunication facilities, electronic products, high-speed rail equipment, automotive chemical products, and photovoltaic devices. However, compared with developed countries, China still lags far behind as regards high-end manufacturing and modern services with finance at the core. China and developed countries are complementary rather than competitive in the fields of new energy, biopharmaceuticals, and financial innovation. This relationship makes China a huge market for developed countries’ exports of advanced facilities, key components, and services. It also provides opportunities for strategic interaction and cooperation in industrial development between China and developed countries. An example in this regard is the Sino-German strategic industrial cooperation mode, “Made in China 2025 meets German Industry 4.0.” Moreover, upgraded industry in China will promote the research and development progress of developed countries, thus impelling them to optimize the high-end industrial chain through utilization of their superior resources.

New Urbanization Provides New Opportunities to Investors around the World

New urbanization will significantly promote the development of China’s service industry and relevant industries, so creating investment opportunities for overseas capitals. In 2015, China had 770 million permanent urban residents – 22 million more than at the end of the previous year, and 600 million permanent rural residents – 15.2 million less than at the end of 2014. Urban residents thus account for 56.1 percent of the total population. China’s urbanization rate is expected to hit 60 percent by 2020, according to calculations. Urbanization progress will lead to a surging demand for investment in the public service sector, including infrastructure, affordable housing construction, education, healthcare, and environmental protection. It will also correspondingly boost investment in relevant industries such as food, home appliances, automobiles, energy, and steel. In that sense, China’s new urbanization will lead investment into a new round of growth that will undoubtedly contribute to the expanded economies of both China and the world. New urbanization will also promote development of service industry. Urban residents’ demands for education, tourism, healthcare, child and old-age care, and the requirements of social economic development for finance, logistics, law, technology, accounting, auditing will hence surge. China’s service industry will become an important platform for foreign capital to participate in China’s new urbanization.

In the process of integration of the world economy it has been commonly held that China’s economic transformation will bring new opportunities to other countries around the world. In a survey that the U.S.-based Pew Research Center has conducted in 43 countries, a median of 53 percent believe that China’s growing economy is a good thing for their own economy. Only 27 percent disagree.