A Retrospective Look at 2012 China-EU Relations

By TIAN DEWEN

IT’S a fact that underscores the rebalancing of the world economic order: The European Union is China’s largest trading partner, and China is the European Union’s second-largest, after the United States.

In 2012, China maintained relatively rapid economic growth, while the EU struggled over member states’ debt crises. Though last year was not remarkable in terms of China-EU trade volume, it did see the two entities’ political relationship continue to mature.

In recognition of the importance of building on China-EU economic ties, a systematic and multi-level political relationship has been developed between the two sides. Trade, together with political understanding, ensures China-EU relations should continue to prosper.

|

|

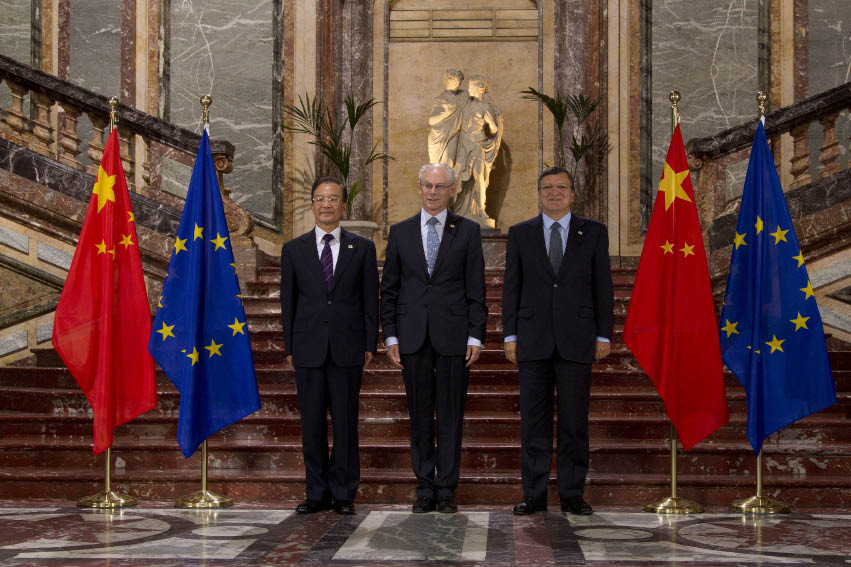

Chinese Premier Wen Jiabao with Herman Van Rompuy, president of the European Council, and Jose Manuel Durao Barroso, president of the EU Committee, at the 15th China-EU Summit in Brussels. |

A Relationship Changing with the Times

Trade and economic ties have been the historical cornerstone of China-EU relations. Despite rapid changes in world trade relationships, since the mid-1990s the rise in bilateral trade volumes has maintained robust momentum. And in 2012, despite the sluggish world economy, China and the EU maintained a basically stable economic and trade relationship. Accompanying this trend are continued shifts in the two parties’ positions in the global economic landscape and the recurring threat of protectionism in Europe, evidenced last year by a growing number of trade frictions involving ever-greater monetary stakes.

According to the latest data released by China’s Ministry of Commerce, the European Union remained China’s biggest trade partner in 2012. Due to the European economic slump, in the first nine months of 2012, Chinese exports to the EU registered US $250.46 billion, representing a year-on-year drop of 5.6 percent. China’s imports from the EU, however, clocked a year-on-year increase of 2.1 percent to US $160.53 billion. Meanwhile, data released by Brussels show that China continues to be the EU’s second largest trade partner, with bilateral trade valued at €46 billion less than the total trade sum between the EU and the U.S.

With regards to investment, China’s Ministry of Commerce reports that the first 10 months of last year saw the 27 EU countries establish 1,418 new enterprises in China, a year-on-year increase of 2.75 percent. However, investment in real terms amounted to US $5.236 billion, representing a drop of 4.95 percent from 2011. Germany remained the biggest European investor in China, funneling US $1.279 billion into the country from January through October. Counted separately, Germany would rank seventh on a list of foreign investors in China by country, followed in Europe by Holland with US $1.01 billion, Britain with US $833 million and Switzerland with US $809 million.

Meanwhile, China’s investment in the EU has increased rapidly. According to data released mid-September by A Capital, a private equity fund, China’s total overseas direct investment increased 67 percent year on year in the second quarter of 2012. The value of investment topped US $24 billion, US $5 billion of which headed to the EU market, a year-on-year increase of 95 percent. Europe is soon to become the top destination for Chinese overseas investment in non-resource industries. Within the EU, the leading recipients of Chinese direct investment include Portugal, Germany and France.

Against a backdrop of woeful economic prospects, intractable sovereign debt crises and the crushing financial burden of bailout packages, Europe has to certain extent “turned in” on itself. Voices arguing for protectionist trade policies have been on the rise. The continent’s trade with China has been used as a convenient scapegoat for the region’s economic woes.

Last year correspondingly saw a rise in China-EU trade frictions. In July, European solar companies headed by German SolarWorld AG officially lodged a complaint with the European Commission and requested an investigation into possible “dumping” in Europe of photovoltaic products by Chinese firms. In September, the commission launched its investigation.

Today, Europe is the world’s largest market for photovoltaic products, and also a main destination for Chinese exports in the industry. In 2011, the value of China’s photovoltaic products heading to the EU reached € 21 billion, accounting for 73 percent of the industry’s global exports.

The investigation launched against China constitutes the most significant trade dispute in terms of trade value the world has ever seen. From China’s perspective, it appears to be a blatant grab by European solar enterprises in order to secure themselves a bigger slice of a booming industry. If the EU ends up imposing sanctions, China’s photovoltaic enterprises would undoubtedly sustain heavy losses. Such an imposition would elevate trade frictions, as China would likely be forced to counteract by adopting anti-sanction measures.

- Xi Elected Chinese President, Chairman of PRC Central Military Commission

- Li Keqiang Endorsed as Chinese Premier

- Fan Changlong, Xu Qiliang Endorsed as Vice Chairmen of Central Military Commission of PRC

- New Leadership Elected for China's Top Legislature

- Proceedings Initiated for China's Leadership Change