By staff reporter LIU YI

|

|

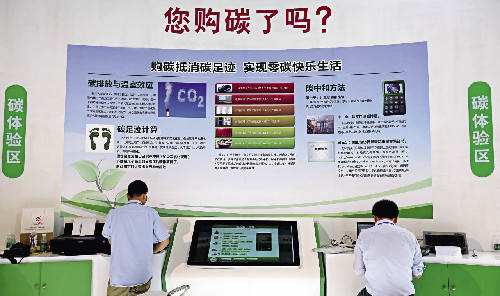

| Visitors try the simulated carbon quota purchase procedure at the Guangdong Carbon Trade Market stand at the China (Guangzhou) International Finance Expo. |

By staff reporter LIU YI

|

|

| Visitors try the simulated carbon quota purchase procedure at the Guangdong Carbon Trade Market stand at the China (Guangzhou) International Finance Expo. |

YANSHAN Petrochemical paid a power plant RMB one million for a 20,000 ton quota of carbon dioxide emissions, on November 28, 2013. This marked the official launch of the Beijing Carbon Trading Market. What’s more, it signaled that “energy conservation and emission reduction” has moved on from being just a slogan to become a key issue, encompassing profits, cash flow and investment.

The Beijing Carbon Trading Market is one of seven pilot markets in China. In June 2013, China’s first carbon market was officially launched in Shenzhen, followed by Shanghai, Beijing, Guangdong Province, and Tianjin – all in the last quarter of 2013. The newest two pilot markets, Hubei and Chongqing, are making intensive preparations. The five markets in operation have established registration systems and trading platforms, as well as detailed supportive regulations including accounting and reporting guidelines for greenhouse gas emissions of enterprises in major industries, third-party verification guidelines, and trading rules. They started a carbon-emission trading system in China from scratch.

|

| Su Wei, director general of Climate Change in the NRDC, is an ardent supporter and propellent of the carbon trade market. Liu Yi |

“We will realize the goal of controlling greenhouse gas emissions through market mechanisms, allowing the market to play a decisive role in resource allocation. This will reduce the social costs of energy saving and carbon reduction, propel institutional innovation and accelerate transformation of the development mode,” Su Wei, director general of Climate Change Department in the National Development and Reform Commission (NRDC), told China Today in an interview, “It is of great significance in boosting overall reform and ecological progress.”