China’s Changing Development Pattern

The consequences for China’s trade are evident. Towards the end of 2013, in inflation adjusted terms, imports by developed economies were 7.0 percent below pre-crisis levels while imports by developing economies were 29 percent above them. Reorientation of China’s trade towards developing economies will therefore continue.

However, this requires continuing change of China’s internal economic structure. Many of China’s exports to developed economies were components for advanced industries, China’s labor costs being low compared to theirs. But outside parts of Asia such advanced manufacturing does not exist in developing economies, and China’s wages are increasingly high compared to many developing economies. For example, China now has a higher per capita GDP than all developing countries in Southeast and South Asia except Malaysia.

China therefore cannot compete in developing economies through low wages any more. It can only maintain a competitive edge through continuously developing “cost innovation” – securing competitive prices not via low wages but by technological development and management strength. This, however, requires growing investments in technology, capital equipment embodying it, R&D, new capabilities such as high level brand development and management training.

This interrelates with the main challenge facing China’s domestic economy. Internationally the fact that trade plays a bigger role in China’s economy than in the U.S. maintains strong competitive pressure on Chinese companies, forcing them to increase their efficiency. But the transition from competitiveness achieved via low wages to that based on innovation and technology is a reason why, as economies become more advanced, investment plays an increasing role in their growth. International studies show that on average, investment accounts for 57 percent of growth in an advanced economy compared to 52 percent in developing economies. As investment must be financed through savings by companies, households and government, maintaining high savings and ensuring their transformation into investment is China’s most fundamental macroeconomic task.

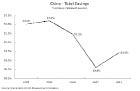

It is in this area that the international financial crisis created economic problems for China. As the chart shows, under its impact China’s savings rate fell from 53.2 percent of Gross National Income to 51.4 percent in 2012 – the latest available data. Industrial profitability rose less rapidly than GDP.

There is no indication that savings levels rose significantly in 2013. As savings are the supply of capital, given these have fallen, either interest rates, the price of capital, must rise or the demand for capital, that is investment levels, must fall.

Consequently China’s rising interest rates in 2013 and 2014, increasing the cost of company and government borrowing, and in June and December 2013 creating interest rate spikes in interbank lending, reflected this. It is therefore a major challenge to rebuild China’s savings rate to finance the high levels of investment needed to upgrade its development path.

This also affects issues such as environmental protection. Greater environmental protection, to eliminate smog for example, requires high investment given that non-polluting power stations, factories etc. are more expensive than polluting ones.

In only a decade China, by international classifications, will become a high-income economy whose growth is more dependent on investment in innovation, both technological and management, than on low wages. China came more successfully through the international financial crisis than any other major economy. But China continues to face for a significant period a “Great Stagnation” in the advanced economies. Its development priorities need to reflect this.

- Are You Ready to Perform?

- Beijing’s Green Courtyard

- China’s CSR on the Global Market Fast Track – An Interview with Xu Zongxiang, vice president of China South Locomotive & Rolling Stock Corporation Limited (CSR)

- China’s Changing Development Pattern

- China Accelerates Transformation of Its Economic Development Model