China’s Changing Development Pattern

Taking only bilateral comparisons with the U.S., over the whole period 2007-2013 the U.S. economy grew by only 6.0 percent while China grew by 67.7 percent. Since the beginning of the financial crisis, China overtook the U.S. to become world number one in trade in goods, in industrial production, and in annual savings – the finance available for investment.

But despite China coming through the international financial crisis more successfully than other major economies, it would be utopian to imagine it would suffer no bruises from the world’s greatest economic crisis for 80 years. China therefore simultaneously faces the challenge of repairing any economic damage and preparing for the next period of economic development – as will be seen the two coincide.

Internationally there is no reason to anticipate sharp acceleration in the advanced economies. In all major developed economies investment, economic growth’s main driver, remains below pre-crisis levels. In the last five years the U.S. and EU persistently underperformed projections made in advance by the IMF – meaning its 2.2 percent projection for advanced economy growth in 2014 is probably best taken as an upper bound. In contrast, despite some slowing, economic growth in developing economies remains more rapid due to higher investment levels, and the IMF projects 5.1 percent growth in 2014.

The consequences for China’s trade are evident. Towards the end of 2013, in inflation adjusted terms, imports by developed economies were 7.0 percent below pre-crisis levels while imports by developing economies were 29 percent above them. Reorientation of China’s trade towards developing economies will therefore continue.

However, this requires continuing change of China’s internal economic structure. Many of China’s exports to developed economies were components for advanced industries, China’s labor costs being low compared to theirs. But outside parts of Asia such advanced manufacturing does not exist in developing economies, and China’s wages are increasingly high compared to many developing economies. For example, China now has a higher per capita GDP than all developing countries in Southeast and South Asia except Malaysia.

China therefore cannot compete in developing economies through low wages any more. It can only maintain a competitive edge through continuously developing “cost innovation” – securing competitive prices not via low wages but by technological development and management strength. This, however, requires growing investments in technology, capital equipment embodying it, R&D, new capabilities such as high level brand development and management training.

This interrelates with the main challenge facing China’s domestic economy. Internationally the fact that trade plays a bigger role in China’s economy than in the U.S. maintains strong competitive pressure on Chinese companies, forcing them to increase their efficiency. But the transition from competitiveness achieved via low wages to that based on innovation and technology is a reason why, as economies become more advanced, investment plays an increasing role in their growth. International studies show that on average, investment accounts for 57 percent of growth in an advanced economy compared to 52 percent in developing economies. As investment must be financed through savings by companies, households and government, maintaining high savings and ensuring their transformation into investment is China’s most fundamental macroeconomic task.

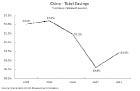

It is in this area that the international financial crisis created economic problems for China. As the chart shows, under its impact China’s savings rate fell from 53.2 percent of Gross National Income to 51.4 percent in 2012 – the latest available data. Industrial profitability rose less rapidly than GDP.

There is no indication that savings levels rose significantly in 2013. As savings are the supply of capital, given these have fallen, either interest rates, the price of capital, must rise or the demand for capital, that is investment levels, must fall.